The Systematic Investment Plan (SIP): Building Wealth, One Sip at a Time

This document provides a comprehensive overview of Systematic Investment Plans (SIPs) as

an investment strategy. It explains what an SIP is, how it works, its key benefits, and the valueadded services offered by Mutual Cafe. It also compares SIPs with lump sum investments to

help investors make informed decisions.

What is an SIP?

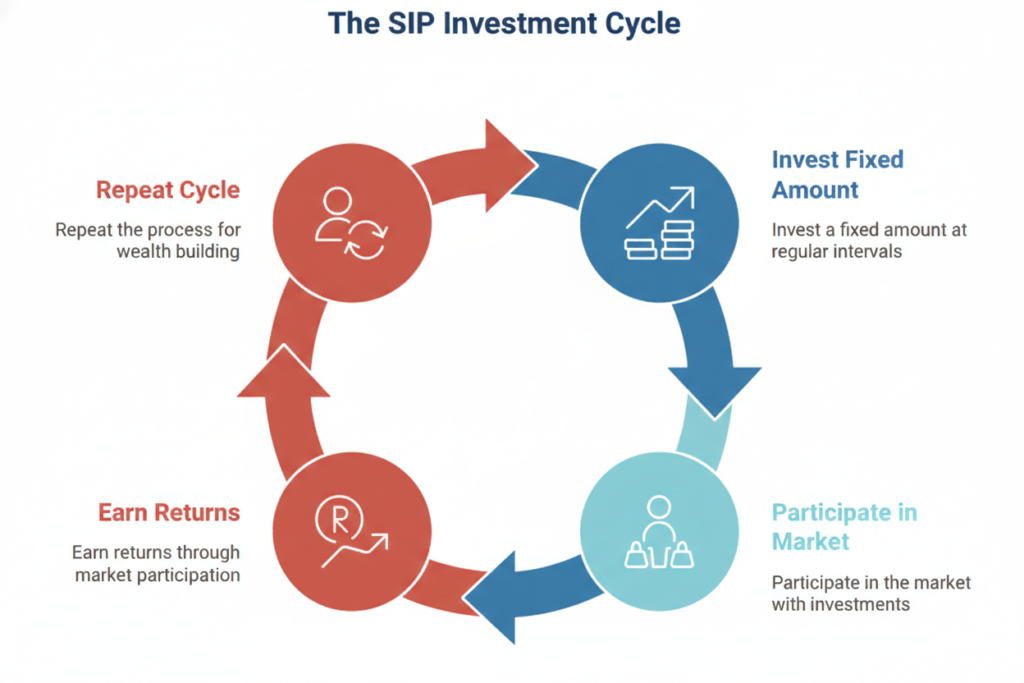

A Systematic Investment Plan (SIP) is a disciplined and strategic approach to investing in

Mutual Funds. Instead of investing a large lump sum amount all at once, an SIP allows you to

invest a fixed amount at regular intervals, such as monthly, quarterly, or even weekly. Think

of it as a Recurring Deposit (RD), but with the potential for significantly higher returns through

participation in the market.

How It Works (The "Secret Ingredients")

The SIP strategy leverages two powerful financial principles that make it a popular choice for

investors:

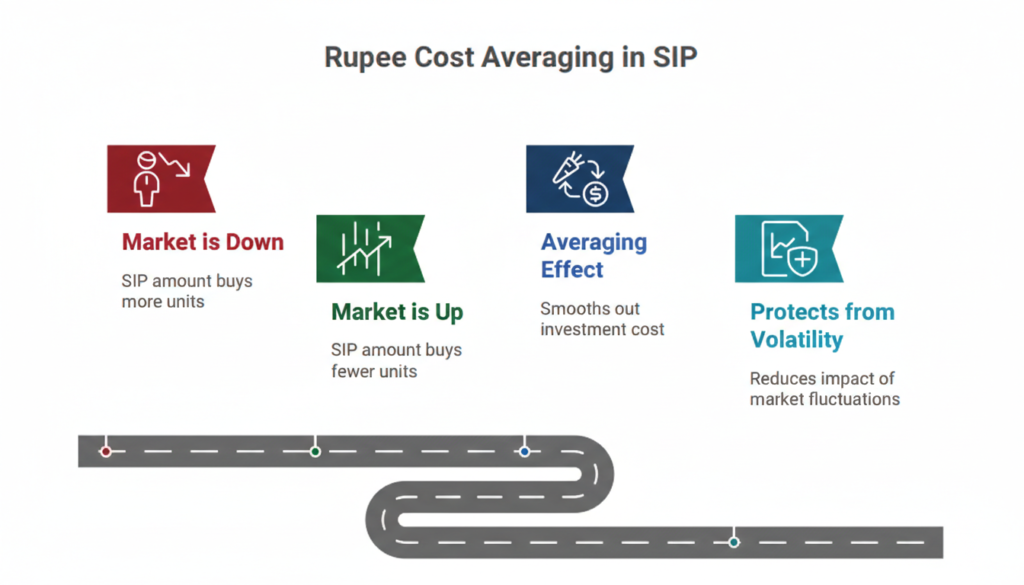

Rupee Cost Averaging

With an SIP, you don’t need to try and “time the market.”

When the market is down, your fixed SIP amount buys more units of the mutual fund.

Conversely, when the market is up, it buys fewer units. Over time, this averaging effect

helps to smooth out the cost of your investment and protect you from the impact of

market volatility.

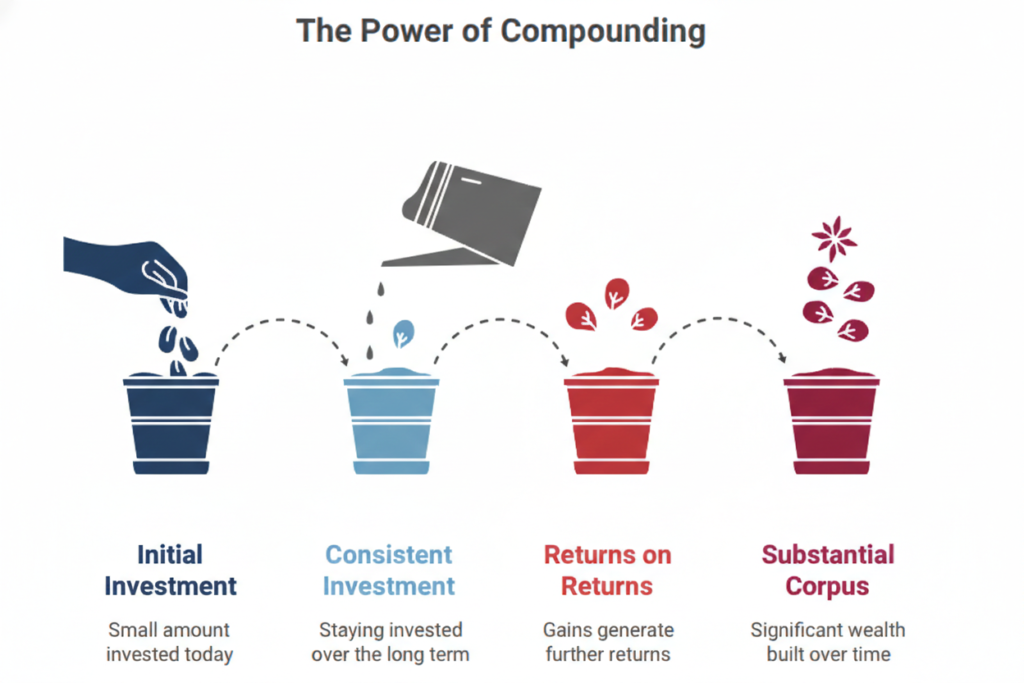

The Power of Compounding

By staying invested consistently over the long term, you

benefit from the power of compounding. This means you earn “returns on returns,”

where the gains from your initial investment also generate further returns. Even small

amounts invested today can grow into a substantial corpus over a period of 10–15

years or more.

3. Key Benefits for You

- Pocket-Friendly: You can start your investment journey with an SIP with as little as ₹500 per month, making it accessible to a wide range of investors.

- Disciplined Savings: The SIP amount is automatically debited from your bank account at regular intervals, ensuring you save consistently before you have a chance to spend the money. This helps to build a strong savings habit.

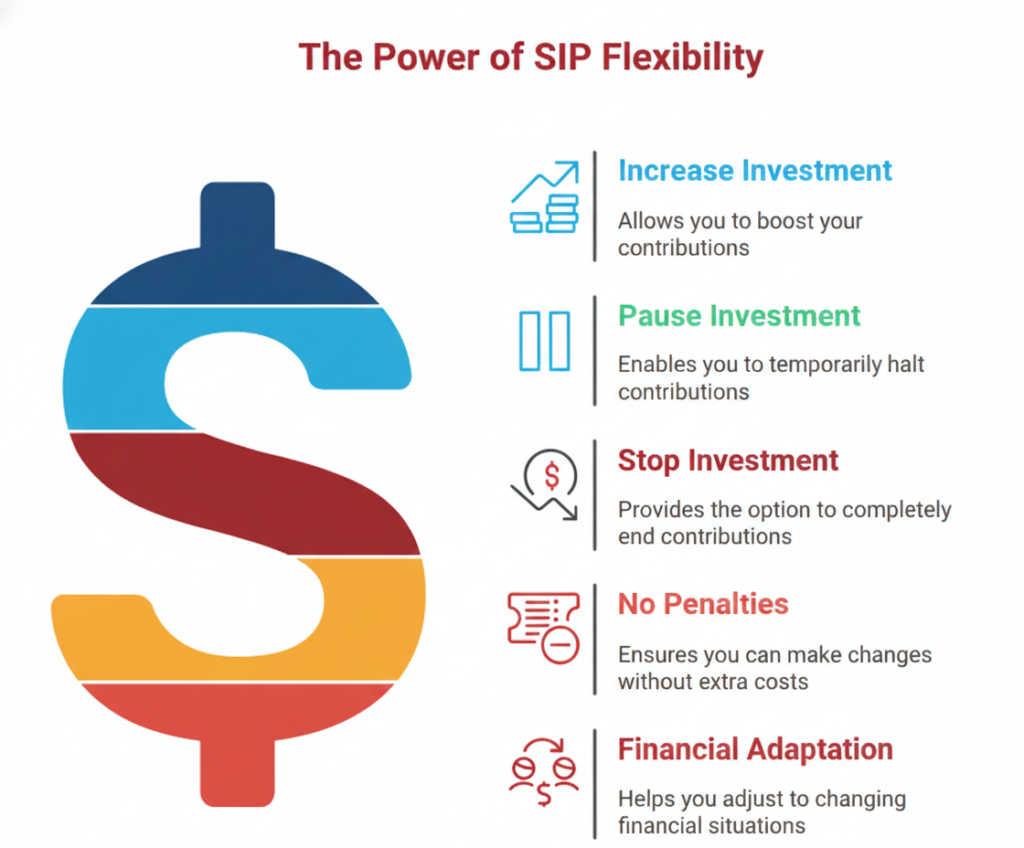

- Flexibility: You have the flexibility to increase (Top-up), pause, or stop your SIP at any time without incurring any penalties. This allows you to adjust your investment strategy based on your changing financial circumstances.

- Goal-Based: At Mutual Cafe, we help you align each of your SIPs with a specific financial goal, such as your child’s education, the purchase of a new home, or your retirement planning. This helps you stay focused and motivated on achieving your long-term financial objectives.

4. Mutual Cafe’s Value Add

While the concept of an SIP is relatively simple, selecting the right mutual fund for your

investment goals and risk tolerance can be challenging. This is where Mutual Cafe comes in.

As your consultants, we provide the following value-added services:

- Fund Selection: We filter through a vast universe of over 2,500 mutual fund schemes to identify the ones that best match your individual risk appetite, investment goals, and time horizon.

- Regulatory Compliance: We ensure that every fund we recommend adheres to the strict guidelines and regulations set forth by the Securities and Exchange Board of India (SEBI), providing you with an added layer of safety and security for your investments.

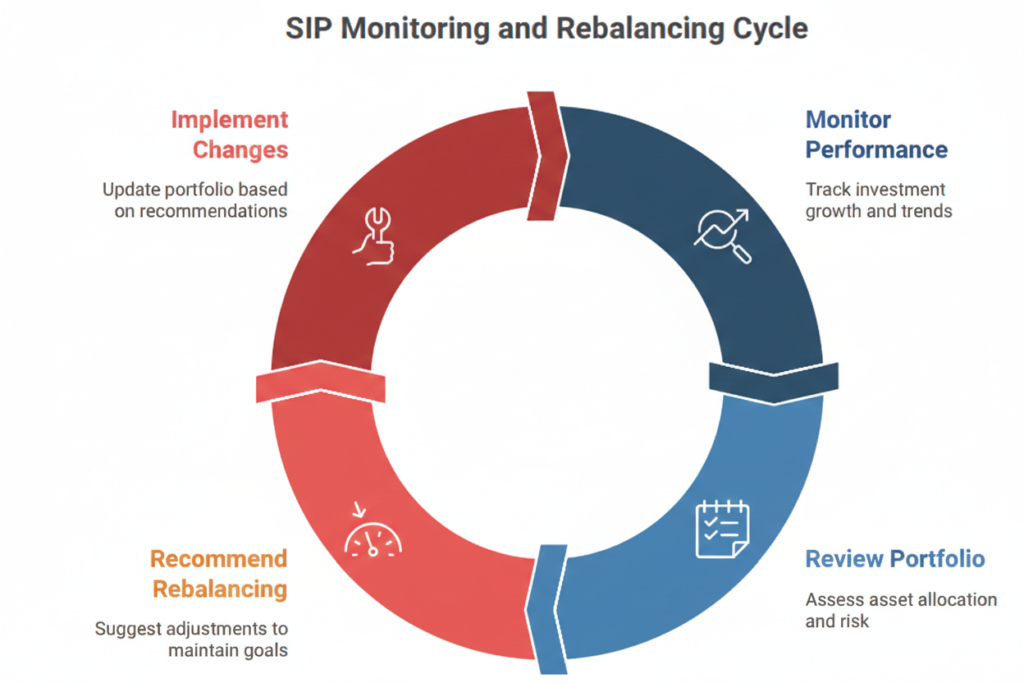

- Monitoring & Rebalancing: We don't just "set it and forget it." We continuously monitor the performance of your SIP investments and periodically review your portfolio to ensure that you stay on track to achieve your financial goals. If necessary, we may recommend rebalancing your portfolio to maintain your desired asset allocation and risk profile

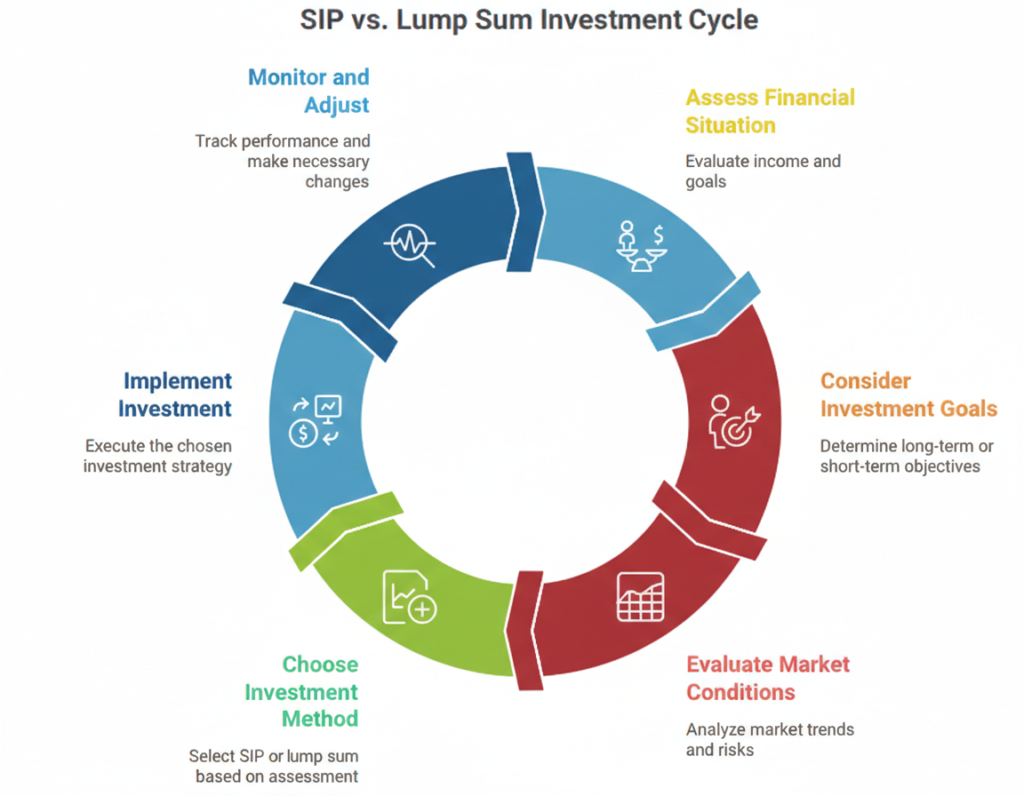

5. Wealth Comparison: SIP vs. Lump Sum

| Feature | Systematic Investment Plan (SIP) | Lump Sum

Investment |

| ————————— | ——————————– | ————————————————- |

| Best For | Salaried individuals & long-term goals. | One-time windfall (bonus, gift,

asset sale). |

| Market Timing | No need to time the market. | High risk if invested at a market

peak. |

| Risk Level | Lower (Risk is spread over time). | Higher (Capital is exposed all at

once). | | Discipline | High (Automated habit). | Low (Depends on available

surplus). |